refinance transfer taxes florida

Additional 450 for electronic submission fee. In Florida there are two distinct transfer tax rates.

Echfa The Escambia County Housing Finance Authority

If the property is within Miami-Dade county the transfer tax is 06 of the sale price.

. Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands. 70 per 100 or portion thereof of the total consideration paid or to be paid for the transfer. State laws usually describe transfer tax as a set.

As a result Florida had the eighth-lowest tax burden defined as the state. Ad Start Your Refinance With Americas 1 Online Lender. Find the Best Refinance Option Just for You.

There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida. It might also be added that apparently there is a. Intangible tax on promissory note Buyer Expense Documentary stamp tax on Mortgages Buyer Expense are taxed based on the.

The tax rate for documents that transfer an interest in real property is. 19 hours agoThis time last week it was 730. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes.

Refinance Your Mortgage Into A Low Interest Rate. While a 480000 refinance in the Miami market may have all-in title recording and taxes of 6400-6900. However pursuant to section 199143 3 FS a line of credit obligation is also subject to the nonrecurring intangible tax to the extent secured by a mortgage on Florida real property.

Ad Lock Your Rates For Up To 90 Days. As far as I know lenders can charge a transfer tax if youre refinancing the loan. Sometimes a refinancing lender will agree to structure a.

Estimate your Florida title insurance costs with our refinance insurance calculator if you decide to refinance your home in Florida. Easily calculate the south carolina title insurance rates and. For transactions where title is transferred such as a sales transaction the documentary stamps in Florida are calculated at a rate of 70 cents per 10000 of the sales.

Close a Loan In 25 Days Start Saving Money. Refinance Property taxes are due in November. Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

Transfer tax can be assessed as a percentage of the propertys final sale price or simply a flat fee. To calculate the amount of transfer tax you owe simply use the following. 500 number of taxable units.

Florida 3500 Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. For example if a property is purchased for 200000 first divide the sales price by 100 then multiply by 70 for a total of. A 20-year fixed-rate mortgage refinance of 100000 with todays interest rate of 731 will cost 794 per month in principal and interest.

The California Revenue and Taxation Code has set this tax for all counties at 110 per 1000 or 055 per 50000 to be exact per the Code of the transfer value sales price of. The rate is equal to 70 cents per 100 of the deeds consideration. Calculate Your New House Payment Now Start Saving On Your Mortgage.

There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida. The consideration for the transfer is 50000 the amount of the mortgage multiplied by the percentage of the interest transferred. Nevertheless you should contact a real estate attorney and take his opinion in this regard.

Take Time To Choose The Best Rate Lower Your Payments. Transfer taxes are not tax-deductible against.

Reducing Refinancing Expenses The New York Times

Transfer Tax And Documentary Stamp Tax Florida

Real Estate Transfer Taxes Deeds Com

Transfer Tax And Documentary Stamp Tax Florida

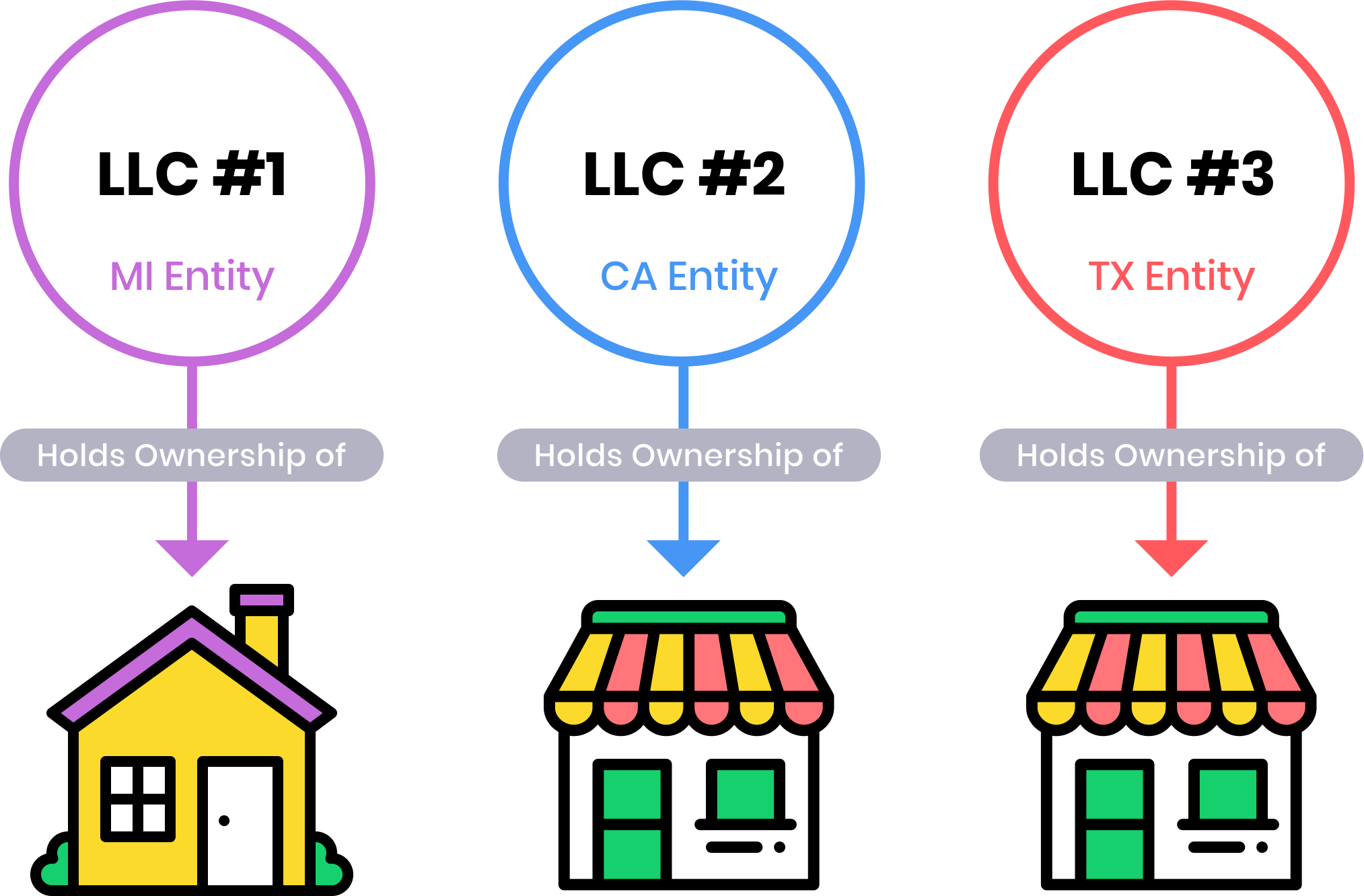

Should I Transfer The Title On My Rental Property To An Llc

Complete Guide To 2021 Closing Costs In Florida Newhomesource

Real Property Transfer Taxes In Florida Asr Law Firm

Florida Gift Tax All You Need To Know Smartasset

Smart Faq About The Dc Transfer And Recordation Tax Smart Settlements

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Adding A Name To A Deed In Florida Asr Law Firm

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Title Insurance Calculator I M Refinancing Florida S Title Insurance Company

12 10 2020 Calculating Transfer Taxes For Florida Real Estate By Azure Tide All Florida School Of Real Estate Learn How To Calculate Documentary Stamp Taxes And Intangible Taxes In

What Are Real Estate Transfer Taxes Bankrate

Transfer Tax In A Refinance Transaction Property Legal Counsel